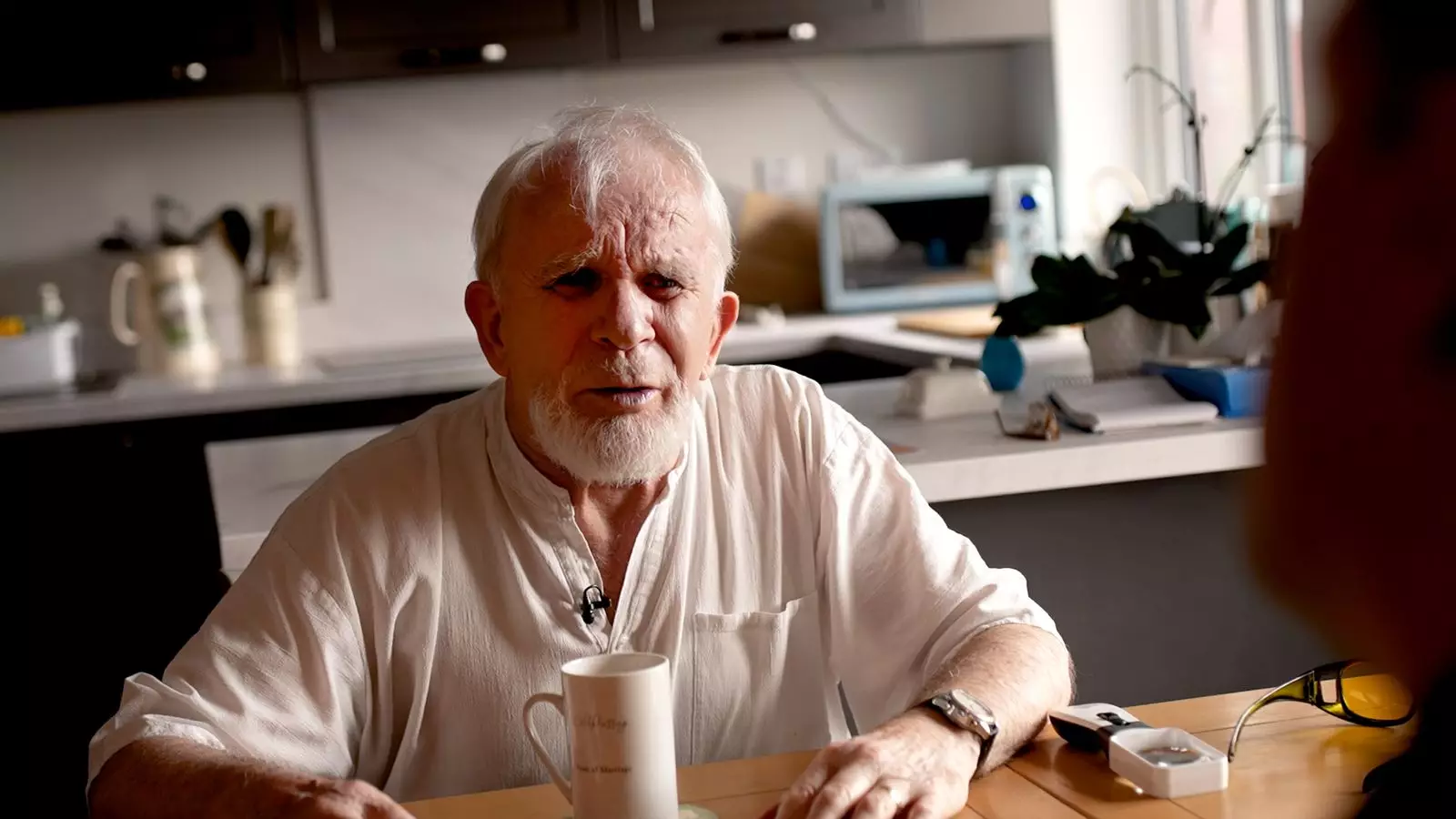

As the chill of winter approaches, the apprehensions of the elderly are becoming increasingly palpable, particularly among those with scant financial resources. Kevin McGrath, an 81-year-old resident of Corby, Northamptonshire, exemplifies this anxiety. Recovering from a significant eye surgery, McGrath expresses profound concern over government policies targeting vulnerable pensioners. Previously a Roman Catholic monk and now a dedicated social worker, McGrath conveys a poignant frustration at the proposal to revoke winter fuel allowance for millions of seniors. This allowance, a crucial financial lifeline, is being stripped away from those in modest circumstances, a decision he deems “evil.”

Pensioners like Kevin and his wife have resorted to downsizing, moving into a two-bedroom apartment to mitigate rising energy costs. With no private pensions to rely on, their state pension represents their sole source of income. Recent announcements from Chancellor Rachel Reeves indicate that from this winter onward, only pensioners receiving Pension Credit or specific means-tested benefits will continue to qualify for winter fuel payments. This shift poses a significant concern for the over 10 million pensioners who benefitted from these payments last winter.

The Ethical Implications of Means Testing

McGrath emphasizes the ethical implications of this decision, questioning why the government would choose to target those at the bottom of the economic ladder instead of focusing on wealthier demographics. “It’s a crime,” he asserts, portraying a sentiment that many in his community share. The requirement for individuals to apply for Pension Credit to demonstrate their financial need adds another layer of distress for elderly citizens. For many, this process is not only cumbersome but also a source of embarrassment. They feel a disconcerting pressure to prove their financial hardships, with McGrath noting that this situation fosters feelings of shame among his peers.

This rising embarrassment is further corroborated by data from the charity Independent Age, which has noted a surge in inquiries about Pension Credit. In August, the volume of calls regarding this benefit was three-and-a-half times higher than in the previous months, reflecting a growing anxiety among older adults. The perception that they must justify their economic status has left many feeling vulnerable. Joanna Elson CBE, chief executive of Independent Age, highlights that numerous older individuals perceive this reduction in support as a dire threat to their welfare.

The perspective of people like McGrath illustrates the human cost of policy changes. The elderly, particularly those on fixed incomes, often live in a reality where even minor expenses can become unattainable. The government’s rationale for these cuts, framed as a necessary response to a projected £22 billion budget deficit, fails to resonate with those who will bear the brunt of these financial decisions. Many pensioners are now facing the prospect of a bleak winter, compounded by the hurdles of navigating the benefits system.

Despite the government’s assurances of maintaining the triple lock on the state pension—a system that guarantees yearly increases based on inflation, earnings, or at least 2.5%—these policies raise questions about the adequacy of support. While the increase in pensions over the next years appears promising on paper, it is overshadowed by the immediate financial concerns of many seniors. For McGrath, this juxtaposition evokes a sense of despair rooted in systemic neglect of the elderly. “If you’re not economically active, you don’t matter,” he reflects grimly, manifesting a sentiment not uncommon among his demographic.

In response to these concerns, a government spokesperson reaffirmed its commitment to supporting pensioners, noting that the upcoming rise in pensions will benefit over 12 million individuals. However, this assurance rings hollow for many who fear the immediate repercussions of winter hardship without adequate fuel allowances.

As winter looms closer, the gaps in policy continue to widen, raising significant ethical questions about the treatment of the elderly in society. McGrath’s poignant observations encapsulate a growing crisis that demands urgent reflection. Policymakers must consider the broader implications of their decisions—decisions that significantly affect the lives of those who have contributed to society throughout their working years. With the impending winter, it remains to be seen how these challenges will unfold for the elderly community and whether their voices will be heard amidst the cacophony of financial rhetoric.

Leave a Reply