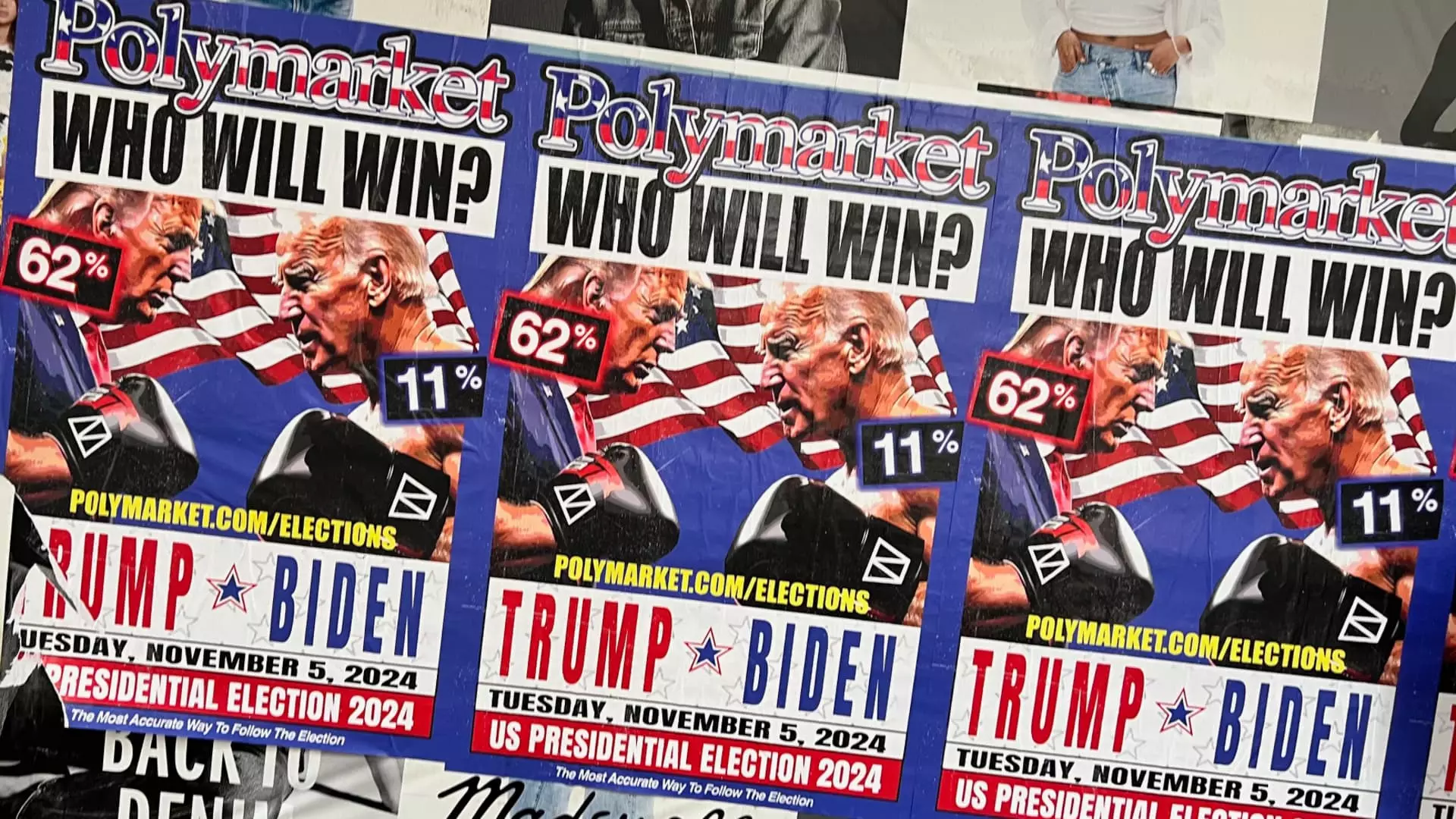

The landscape of political forecasting is evolving dramatically, with platforms like Polymarket leading the charge. After accurately predicting the electoral victory of now-President Donald Trump, Polymarket, an online prediction market, is poised to once again cater to American customers. This resurgence comes on the heels of a significant historical moment for political prediction markets in the U.S.; the movement to legalize such platforms has gained traction, aided by innovative thinkers like Polymarket’s founder, Shayne Coplan. Speaking on a recent episode of “Squawk Box,” Coplan emphasized the importance of this legislative progress and the opportunities it presents for expansion.

Since Polymarket halted its U.S. operations in 2022 due to regulatory issues, including a hefty $1.4 million fine from the Commodity Futures Trading Commission (CFTC) for failing to register, its return signals an important shift. The reinstatement of political prediction markets could potentially change how political events are understood and forecasted. As Coplan noted, the staking of real money in these predictions alters the reliability of the outcomes, making them more compelling than traditional polling methods.

The Legal Landscape and Emerging Competitors

The re-emergence of Polymarket is also influenced by recent judicial and regulatory developments. Notably, a U.S. Appeals Court decision lifted a previous freeze on competitor Kalshi’s election contracts. This ruling signals increased viability for political markets and raises questions about the future competitiveness of these platforms. Judge Patricia Millett, who penned the ruling, underlined the need for a demonstration of “irreparable harm” to maintain the status quo, thus allowing for greater responsibility and accountability in political forecasting.

Following Kalshi’s green light, prominent trading platforms such as Interactive Brokers and Robinhood have also entered the fray, launching their own election contracts. Both companies recognize the potential scale of this market; as Interactive Brokers chairman Thomas Peterffy predicted, the political prediction realm might outstrip traditional equity markets significantly in the coming years. This broadening of the market landscape suggests that political predictions could become a staple of investment strategies, much like stocks and bonds.

What’s particularly intriguing about these emerging platforms is their inherent value proposition. Robinhood CEO Vlad Tenev articulated the unique aspect of money being on the line, which tends to induce genuine concern and involvement in the outcomes. This makes predictions from these platforms potentially more reliable than those derived from conventional polling, which is often influenced by various biases. As real capital is committed to these markets, the stakes are elevated, lending a greater credibility to their forecasts.

Predictive markets like Polymarket and ultimately the success of Trump’s candidacy demonstrated an important truth: the interests of diverse market participants create a nuanced understanding of political dynamics. The volume of trade on these platforms—hovering near $3.7 billion during the recent electoral race—offers a glimpse into the fervor and intensity that surrounds political events today.

The successful prediction of Trump’s victory by platforms such as Polymarket has generated buzz and endorsement from notable figures, including Elon Musk. Musk’s endorsement, where he remarked that Polymarket is “more accurate than polls,” signifies a shift in cultural acceptance of these markets as legitimate entities in political forecasting. As political climates change, and as such markets gain popularity, they could redefine how citizens and analysts alike approach electoral processes and outcomes.

Shayne Coplan’s commentary on Polymarket suggests that we are witnessing a paradigm shift—the “Overton window,” which delineates acceptable political dialogue, is widening. The advent of these prediction markets may encourage more diversified perspectives in political discourse, empowering individuals to engage more proactively in their democratic processes.

As platforms like Polymarket regain their foothold in the U.S., the power of collective foresight and financial stakes may usher in a new era of political forecasting. This merger of finance with predictive analytics could enhance civic participation and elevate the quality of political discourse in the nation.

Leave a Reply