Navigating the financial markets can often feel like traversing through a maze. For investors eager to make informed decisions, understanding the latest trends and events is crucial. As we delve into the recent market shifts, certain pivotal developments provide a glimpse into what investors should focus on for the trading day ahead. Here, we will explore the current market landscape, key corporate happenings, and the broader economic implications that could shape investment strategies.

Recent trading sessions have painted a positive picture for U.S. equity markets. The S&P 500 has demonstrated resilience, notching its fourth consecutive day of gains, with an increase of 0.75%. The tech-heavy Nasdaq Composite outperformed, rising by 1%, indicating a renewed appetite for technology stocks among investors. In a similar vein, the Dow Jones Industrial Average added 235.06 points, concluding the day with a rise of 0.58%. Such gains suggest a recovery sentiment among investors who are closely observing broader economic indicators, particularly the upcoming Federal Reserve meeting.

This optimism correlates with the recent release of the Producer Price Index (PPI), which measures wholesale price changes—a critical indicator before the Fed’s meeting. The PPI showed a modest increase of 0.2% in August, aligning with market expectations. Investors often lean on these indicators to predict monetary policy directions, and with inflation appearing controlled, there may be a perception of stability that underpins current market confidence.

While the stock market rallies, challenges loom for corporations such as Boeing. Over 30,000 workers have initiated a strike following their rejection of a tentative contract agreement with management. This walkout not only halts the production of Boeing’s key aircraft but also tests the company’s ability to overcome recent operational setbacks. The President of the International Association of Machinists and Aerospace Workers has characterized this as an “unfair labor practice strike,” highlighting the tensions between labor and management.

Boeing has responded by expressing a commitment to resolving the labor disputes and re-establishing a constructive relationship with its workforce. Nonetheless, these labor disruptions can significantly impact productivity and profitability, which could lead to fluctuations in stock performance and investor sentiment regarding the company’s future prospects.

In the realm of corporate earnings, Adobe recently reported third-quarter results that initially appeared positive, exceeding Wall Street’s expectations for both revenue and earnings. However, a disappointing fourth-quarter outlook has led to an approximately 8% decline in premarket trading for Adobe. Analysts anticipated a higher forecast, and the company’s guidance falling short raises concerns regarding its future growth trajectory. This event underscores the volatility that can accompany earnings reports, where even a slight miss on guidance can trigger significant stock price reactions.

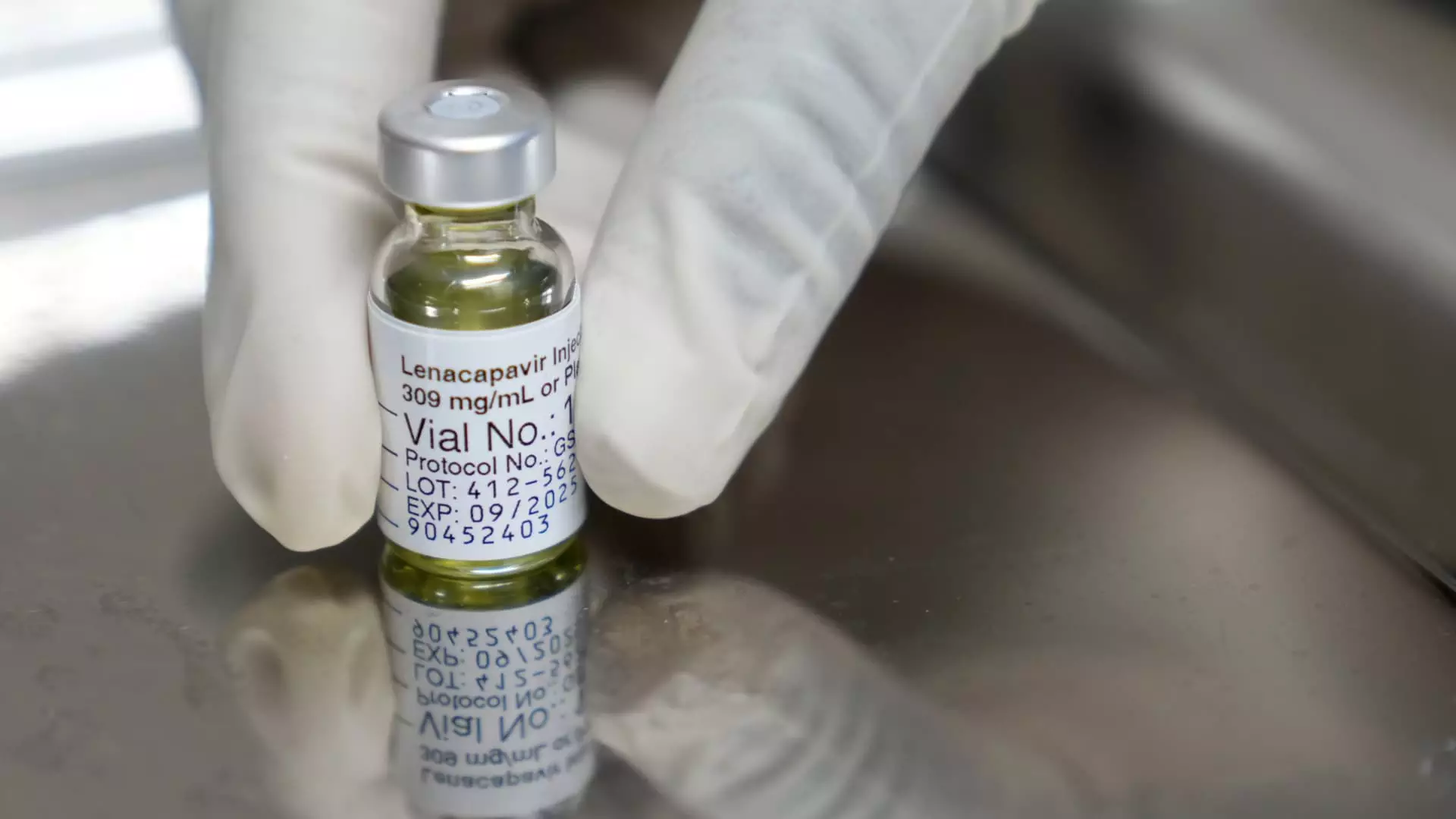

Conversely, Gilead Sciences unveiled promising outcomes for its innovative HIV prevention shot, which demonstrated a dramatic 96% reduction in infections during a large clinical trial. The positive data could pave the way for FDA approval, potentially transforming treatment options in the HIV space. Breakthroughs like these often influence investor perspectives and confidence in pharmaceutical stocks, demonstrating how advancements in healthcare can create lucrative investment opportunities.

The recent legal battles faced by two significant retail players, Tapestry (the owner of Coach) and Capri (Michael Kors), present a unique narrative within the market landscape. The two companies are seeking to merge in an $8.5 billion deal, but the Federal Trade Commission (FTC) has intervened, arguing that the merger might hinder competition in the handbag market. The outcome of this case could have substantial implications for market dynamics, influencing the competitive landscape and possibly elevating prices for consumers.

As the discussions unfold, stakeholders must closely monitor these developments, as corporate consolidations in retail can reshape market structures and impact investor positions.

Navigating the complex landscape of investments requires vigilance and a comprehensive understanding of both macroeconomic indicators and corporate-specific happenings. As we dissect these vital market trends—from rising equity indices and strikes impacting production to a competitive retail merger—the role of informed decision-making becomes evident. Investors are encouraged to stay abreast of these developments, ensuring that they remain well-positioned to adapt their strategies in this dynamic environment. With each trading day offering new insights, the ability to interpret and respond to market signals is essential for successful investing.

Leave a Reply