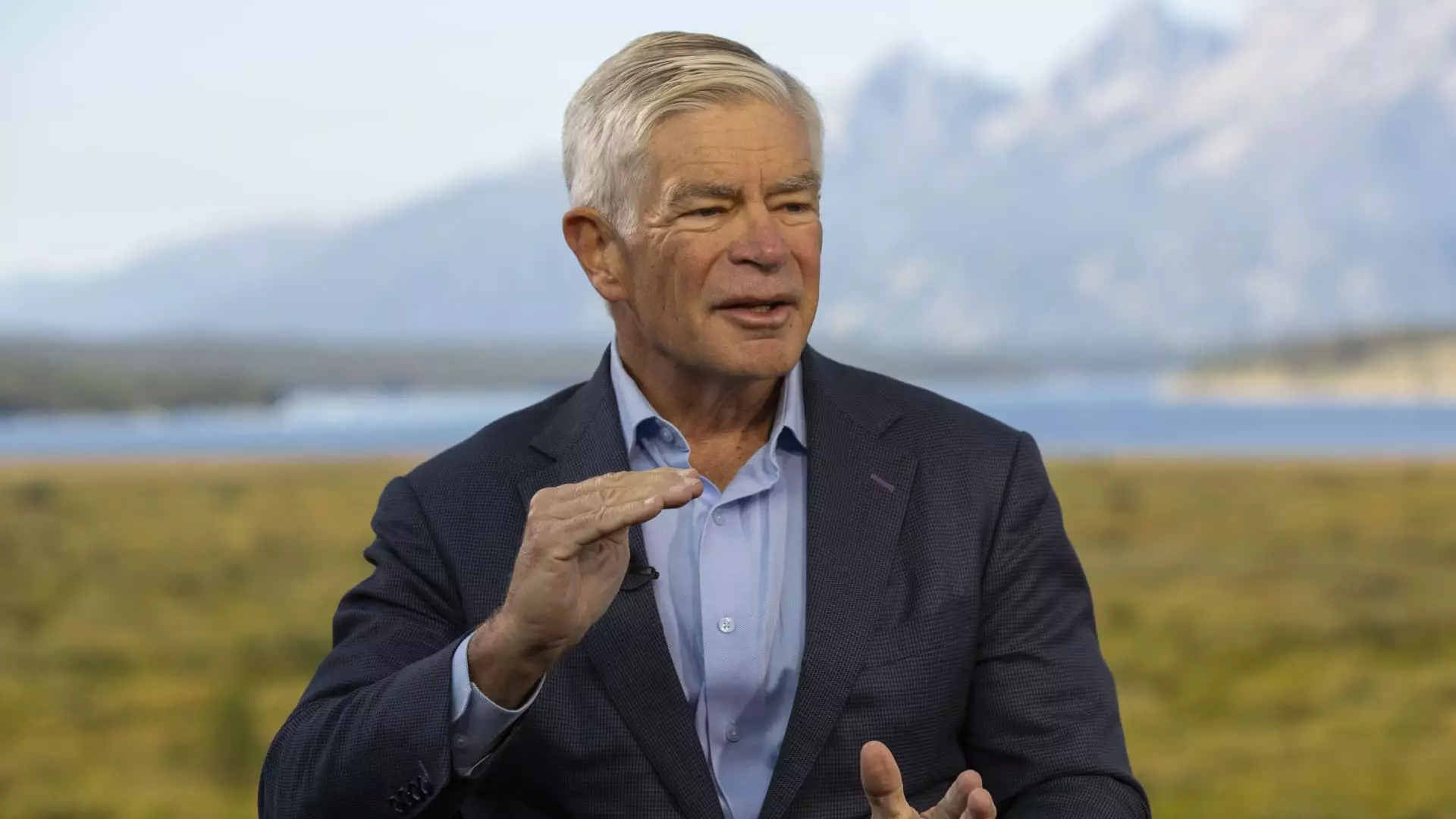

As the financial landscape continues to evolve, the discussions surrounding monetary policy and interest rate adjustments remain pivotal. Recently, Philadelphia Federal Reserve President Patrick Harker shared significant insights regarding potential interest rate cuts during an interview with CNBC at the Fed’s annual retreat in Jackson Hole, Wyoming. This article delves into Harker’s statements and considerations from other Fed officials, examining the implications for the economy, particularly in the context of inflation and labor market dynamics.

Expectations for Interest Rate Cuts

Harker’s unequivocal endorsement of interest rate cuts set a decisive tone as markets anticipate change in September. During the interview, he articulated a clear intention to initiate a reduction in rates, marking a shift in the Federal Reserve’s strategy. The consensus among market participants reflected a strong belief that a 25 basis point cut is imminent, with possibilities also floating around a more aggressive 50 basis point reduction. However, Harker emphasized the importance of continued data evaluation before making a definitive judgment, illustrating the Fed’s cautious approach amid fluctuating economic indicators.

This sentiment resonates with the minutes released from the last Federal Open Market Committee meeting, where the groundwork for a future cut was laid out. As inflation trends and labor market health continue to evolve, it is evident that the Fed’s decision-making process is primarily data-driven, resilient in the face of market volatility when insightful and judicious moves may be necessary.

Harker’s commitment to a methodical and well-communicated approach underscores a fundamental philosophy of central banking: the need for transparent and calculated policy shifts. In his words, “I think it means this September we need to start a process of moving rates down.” This statement not only foreshadows potential monetary easing but also emphasizes the Fed’s role as a technocratic body, prioritizing data over political narratives. The looming presidential election may create pressures, yet Harker’s remarks suggest a strong determination to maintain the integrity of the Fed’s decisions, aligning them solely with economic indicators.

Furthermore, as the Fed has maintained its benchmark rate between 5.25% and 5.5% since July 2023, the shift in policy reflects an ongoing assessment of inflationary pressures. Market reactions witnessed after the July meeting, characterized by an environment of skepticism towards rate cuts, may signify the delicate balance the Fed walks while acknowledging the need for change in a complex economic landscape.

The Labor Market’s Influence

Another notable voice in this discussion was Kansas City Fed President Jeffrey Schmid, who also navigated the implications of rising unemployment rates and the potential for interest rate adjustments. Schmid expressed optimism regarding the labor market’s cooling, which has historically given rise to inflationary pressures through increased wage expectations. However, he urged further scrutiny of current job market dynamics and their alignment with broader economic trends.

The “supply-demand mismatch” previously established in the labor market has been a significant narrative, influencing the Fed’s calculus around inflation. While recent cooling indicators may provide room for cautious optimism, Schmid’s reflections underline the notion that ongoing vigilance is necessary during this transition phase.

As we look towards the Fed’s forthcoming meetings, it is essential to recognize that the interplay between policy decisions and market responses is intricate. Harker’s assertion that his decisions would not be swayed by political pressures emphasizes a crucial aspect of the Fed’s operational ethos—making choices rooted in empirical data rather than external circumstances. The acknowledgment of a labor market adjusting and the possibility of interest rate cuts signify a thoughtful reassessment of overall economic health.

The Philadelphia Fed leadership’s perspectives reflect a broader narrative within the Federal Reserve regarding monetary policy—one shaped by data, cautious optimism, and a commitment to responding aptly to ongoing economic challenges. As September approaches, the implications of these discussions will be closely monitored by market analysts, economists, and policymakers, all keenly aware that the future of interest rates may hinge on the upcoming economic data and trends.

Leave a Reply