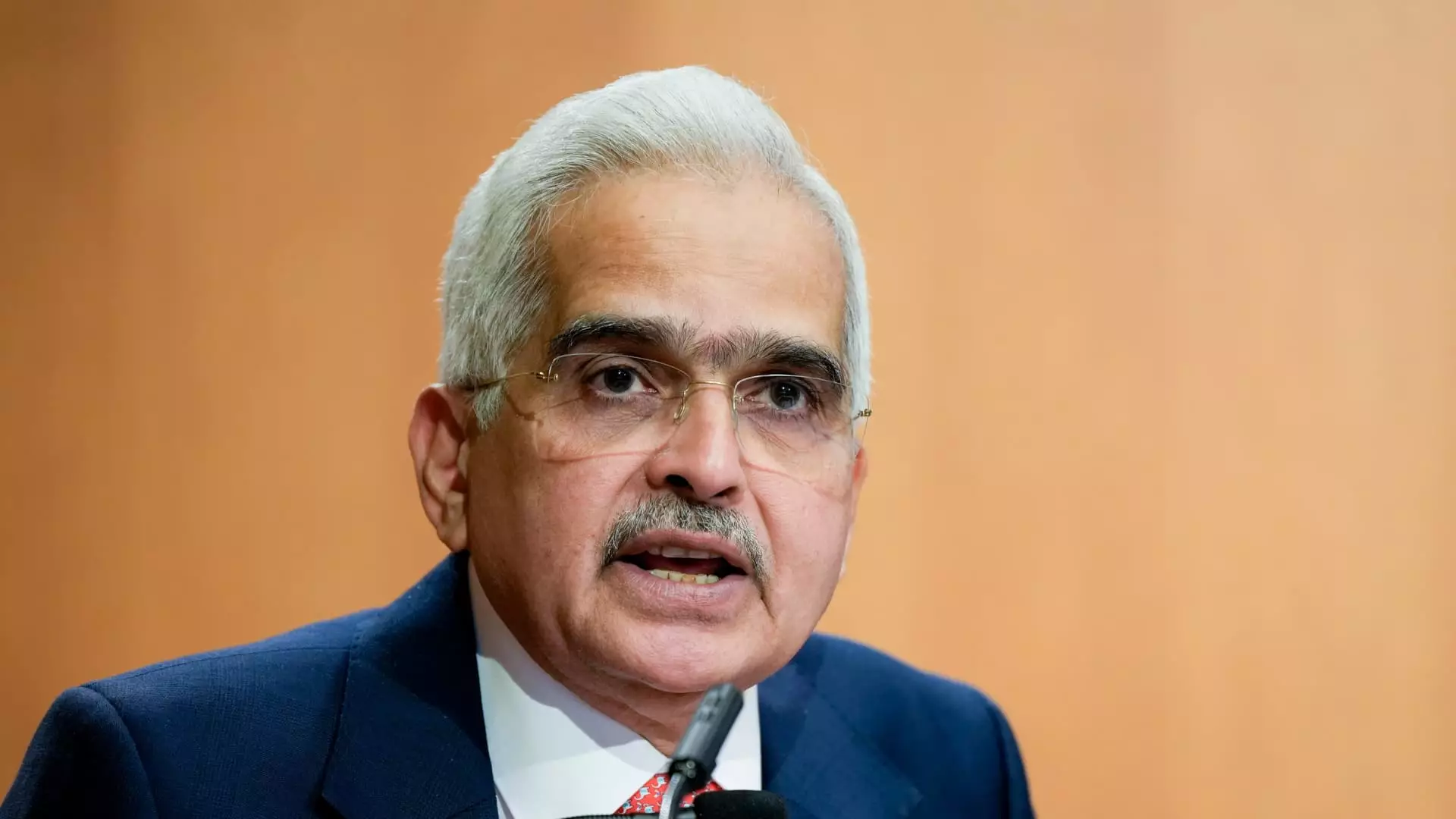

In a world increasingly characterized by uncertainty, the intricate dance of global economies continues to pose challenges for policymakers and financial institutions. Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), recently articulated these complexities during his address at CNBC-TV18’s Global Leadership Summit in Mumbai. He pointed out that despite several unprecedented shocks, such as geopolitical conflicts and fluctuating commodity prices, central banks have managed to navigate these turbulent waters effectively, achieving what can be termed a ‘soft landing’ for many economies worldwide. However, this stability is fragile, and Das emphasized potential risks including the resurgence of inflation and a slowdown in economic growth.

Das’s remarks captured the paradoxical nature of current economic trends. While many regions have managed to stabilize their economies, the specter of inflation looms large on the horizon. He expressed concerns that various geopolitical headwinds—ranging from ongoing conflicts to geopolitical fragmentation—coupled with the volatility of commodity prices and the pressing issue of climate change, pose significant threats to both inflation control and growth stability. The past efficacy of global monetary policies does not guarantee future success, especially as new challenges emerge.

As he predicted inflationary pressures could resurface, Das also highlighted the importance of monitoring international monetary environments closely. For instance, the dynamics of the U.S. dollar that showed surprising resilience even amid rate cuts from the Federal Reserve, further complicate the picture. The dollar’s strengthening raises questions about trade balances and capital flows, reinforcing a sense of unease for other countries, including India.

Underlining his perspective, Das pointed to several market contradictions that exhibited unusual behavior. For example, despite the Fed’s recent interest rate cuts, government bond yields have risen, indicating that economic fundamentals often diverge from policy signals. This situation illustrates how market forces operate based on broader global influences rather than isolated fiscal decisions. Furthermore, the divergence in prices of typically correlated commodities like gold and oil reflects an anomaly that investors must navigate amidst rising geopolitical risks.

Investors are increasingly keen on understanding how political shifts—such as the potential return of Donald Trump to the White House—might dictate future economic policies. Trump’s expected fiscal agenda, including increased tariffs, could ignite inflation dynamics that challenge the Fed’s current strategies of rate reductions.

Focusing on India’s economic landscape, Das lauded the resilience displayed by the nation’s economy through pervasive global issues. The growth trajectory, while facing its own set of challenges, appears optimistic. Inflation indices indicate a tendency towards moderation, although short-term spikes may provoke concern.

In a complementary session at the summit, India’s Union Minister of Commerce, Piyush Goyal, urged the RBI to consider adjusting monetary policy further to endorse growth, particularly in a world where competition for economic leadership is fierce. Goyal’s advocacy for cutting interest rates — in support of spurring economic momentum — aligns with the RBI’s recent pivot to a more neutral stance regarding interest rates. Moving forward, the central bank’s decisions will be critical for sustaining growth in a competitive environment.

As we look to the future, it is evident that policymakers must tread carefully. The balance between fostering economic growth while keeping inflation in check will require astute analysis and proactive measures. The interplay between global developments and local policy adjustments will shape the economic narrative for years to come. With Shaktikanta Das and leaders around the world at the helm, the hope remains that economies can navigate through the intricate maze of challenges while achieving lasting stability and prosperity. As the world moves forward, the insights provided by central bank leaders will be instrumental in fostering international collaboration, ensuring that economies emerge resiliently from the tumultuous conditions of the past decade.

Leave a Reply