The financial markets are often at the mercy of macroeconomic variables, and one of the most significant influences is the Federal Reserve’s manipulation of interest rates. Recent actions by the Fed have ignited a noticeable rally in technology stocks, indicating the strong correlation between interest rates and market performance. Following the Federal Reserve’s initial interest rate cut since 2020, investors flocked to tech stocks, evidenced by significant gains in high-profile companies like Tesla and NVIDIA.

Interest rates are pivotal for investors, particularly in the tech sector where growth companies often rely on borrowing to fuel their expansion. With the Fed’s recent decision to reduce its benchmark interest rate by half a point, the financial landscape has shifted. Lower interest rates mean decreased borrowing costs, which allows companies to invest in new technologies, expand their operations, and ultimately drive growth. As a result, riskier investments become more appealing. The reaction from Wall Street was swift; the Nasdaq composite index soared by 2.5%, marking one of its most significant one-day increases for 2024.

This recovery in tech stocks is particularly remarkable considering the volatile market conditions preceding the rate cut. Investors had grown cautious due to several economic indicators suggesting a potential slowdown. However, with the Fed signaling that additional rate cuts might be on the horizon, investor sentiment shifted rapidly in favor of equities, especially tech stocks, which thrive in lower interest rate environments.

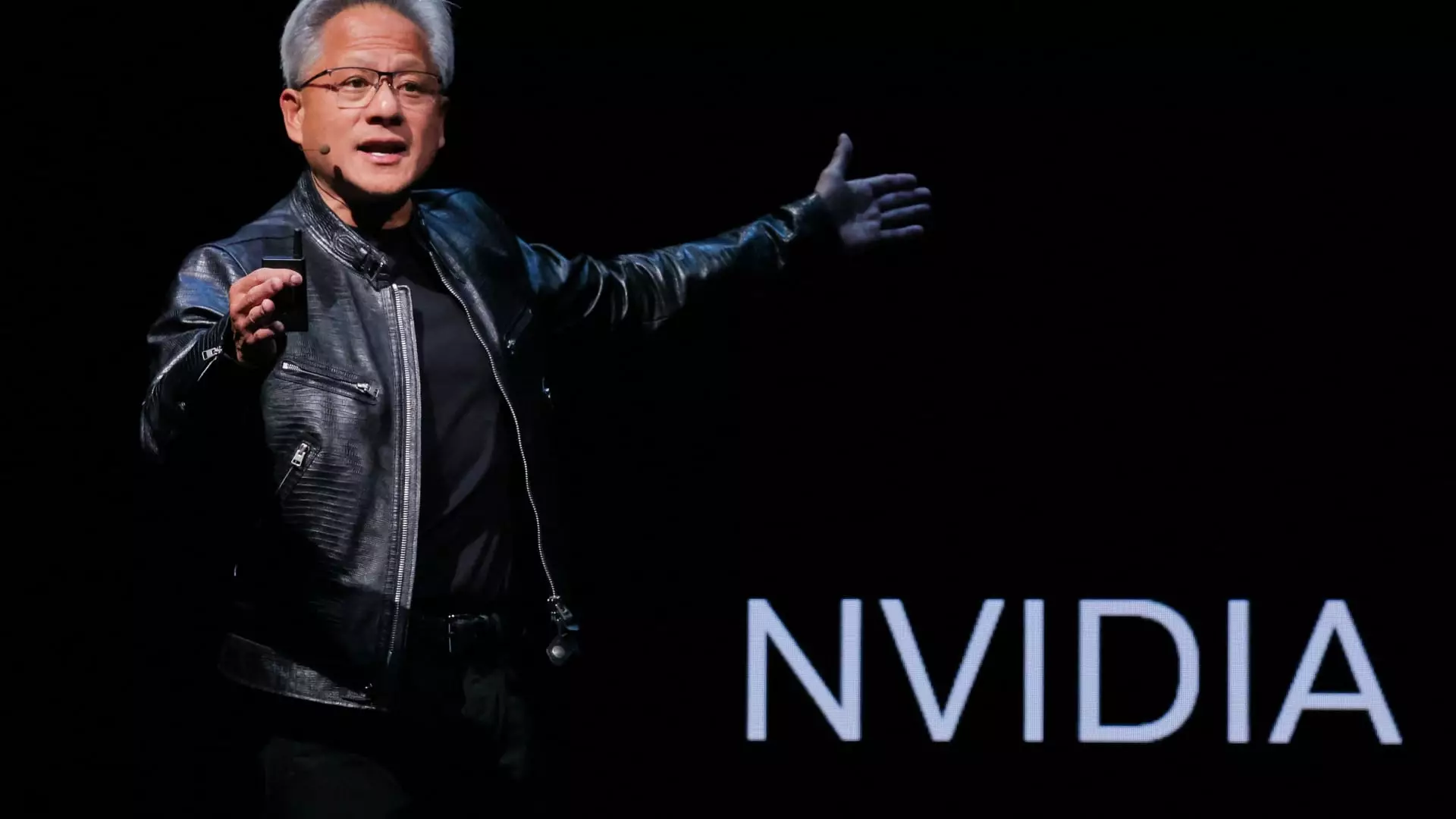

Tesla, a major player in the electric vehicle market, led the surge with a 7.4% increase in its stock price. Historically, Tesla has been a barometer for tech stock performance, and this rally is no exception. Despite earlier struggles that saw its stock dip nearly 2% for the year, the recent sharp increase highlights a renewed interest from investors. Meanwhile, NVIDIA, a cornerstone of the AI revolution due to its cutting-edge processors, also experienced a substantial boost, closing up by 4%.

The dramatic rise of NVIDIA’s stock over the past year—an impressive 138%—indicates not only investor confidence but also the critical role AI technologies play in the current economic narrative. The company supplies essential technology not just for gaming and consumer products but also for enterprise-level AI applications, which are still in their infancy but rapidly evolving. The risk, however, remains that NVIDIA’s concentrated customer base may create vulnerability if demand slows for its products.

While NVIDIA and Tesla basked in the glow of investor confidence, other companies in the tech ecosystem also saw gains. Advanced Micro Devices (AMD) and Broadcom reported notable increases, with AMD’s stock rising 5.7%. AMD is in a challenging position, seeking to carve out a space in the competitive AI sector against titans like NVIDIA. However, company executives acknowledge the long-term nature of AI development, emphasizing the patience required to see returns from current investments.

AMD CEO Lisa Su articulated this sentiment during a recent interview, noting that the industry is still in the early stages of AI applications. This perspective resonates well with long-term investors who understand that technological shifts often unfold over years rather than months. As the sector matures, companies like AMD are strategically positioning themselves to capitalize on future opportunities, despite the immediate pressures.

The rise in tech stocks on Thursday is emblematic of broader market dynamics influenced by Federal Reserve policy. With the Nasdaq approaching its mid-July highs, investor enthusiasm appears renewed, particularly for stocks that have potential in emerging technologies. Companies like Apple and Meta also enjoyed substantial gains, showcasing that the optimism surrounding tech is widespread rather than limited to one or two market leaders.

The recent interest rate cut by the Federal Reserve serves as a crucial turning point for technology stocks. The interplay between Fed policy and stock market performance remains a key narrative as investors navigate through uncertainty. The tech sector, now revitalized, stands as a testament to the resilience and potential of innovation in driving future economic growth, dependent significantly on external economic influences and the companies’ strategic responses. As we look forward, it is essential to monitor how these dynamics evolve and shape the market landscape.

Leave a Reply