The debate surrounding bitcoin continues to intensify as key figures in the technology sector present starkly different approaches to cryptocurrency adoption. Notably, Michael Saylor, co-founder and executive chairman of MicroStrategy, has become a vocal advocate for bitcoin, even encouraging tech giant Microsoft to adopt similar strategies. However, in a recent shareholder meeting, Microsoft’s investors firmly turned down Saylor’s proposal, highlighting the complexities and risks that come with integrating cryptocurrency into mainstream corporate finance.

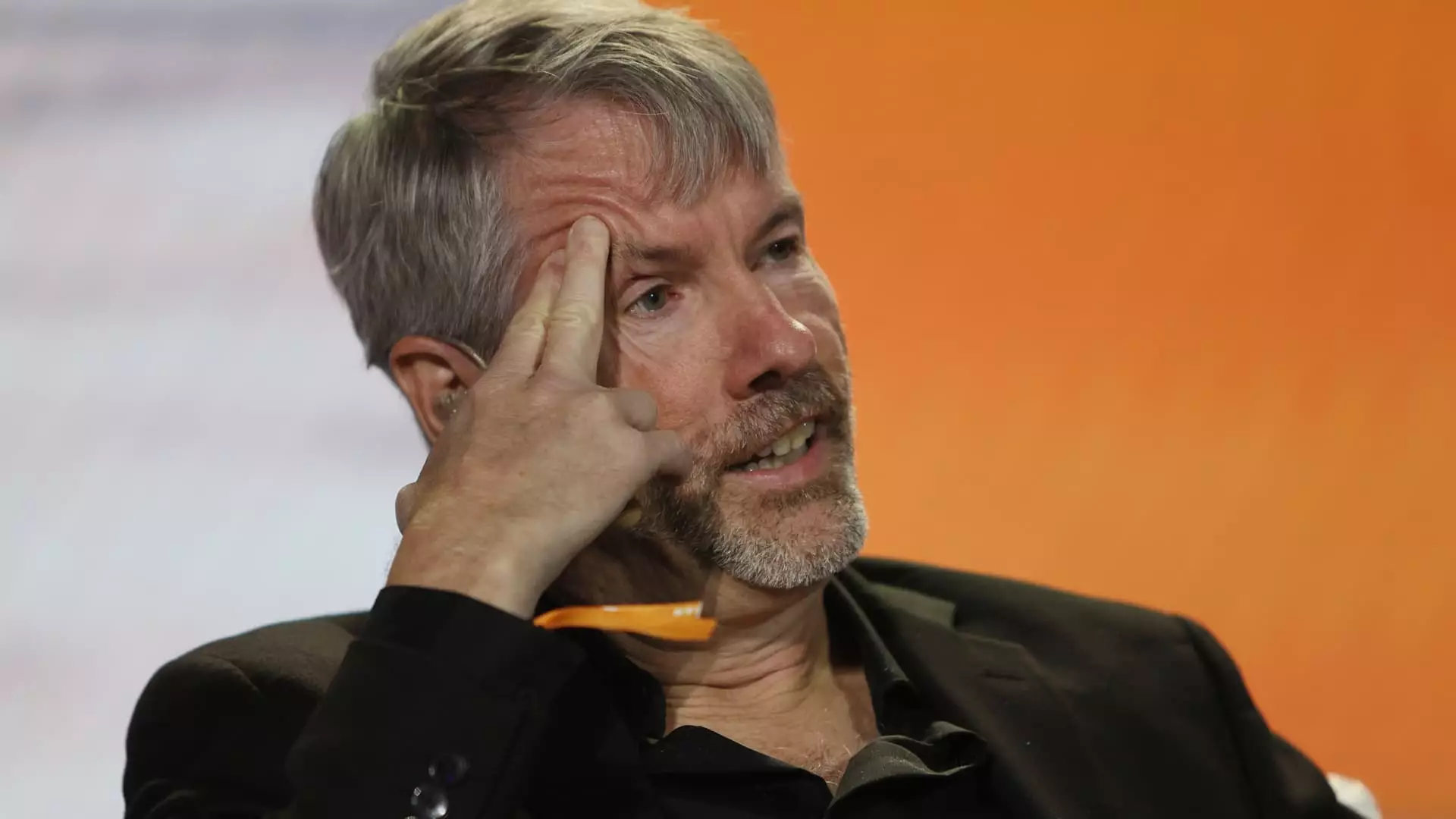

Michael Saylor’s enthusiasm for bitcoin is reflected in MicroStrategy’s transformative shift from a conventional software company to a high-stakes cryptocurrency investor. As bitcoin rallies in value—Saylor reports a staggering 500% increase in his company’s stock this year—he emphasizes the necessity for Microsoft to capitalize on the booming cryptocurrency market. At a high-stakes moment, Saylor presented his case, asserting, “Microsoft can’t afford to miss the next technology wave, and bitcoin is that wave.” This perspective represents a broader trend wherein tech leaders advocate for volatile assets as vital components of future financial strategies.

His argument rested on impressive statistics detailing bitcoin’s robust annual returns of 62% from August 2020 to November 2024, significantly outpacing Microsoft’s 18% and the 14% return of the S&P 500 index. Saylor proposed that if Microsoft were to convert portions of its $78.4 billion cash reserves into bitcoin, it could potentially bolster shareholder value significantly. Such claims pose a compelling narrative for crypto enthusiasts and investors who view traditional financial assets as increasingly outdated.

Despite the alluring potential that Saylor extols, Microsoft remains cautious. The company’s established treasury teams have evaluated cryptocurrencies but thus far remain uncommitted to substantial investments in bitcoin. As per their account, Microsoft has diligently monitored “trends and developments related to cryptocurrencies,” signaling a methodical approach to cryptocurrency integration rather than impulsive participation. The refusal of shareholders to endorse Saylor’s proposal suggests a significant hesitance towards transforming substantial portions of the company’s balance sheet into cryptocurrency—highlighting a preference for stability over speculative risk.

Moreover, investment advisors like Glass Lewis and Institutional Shareholder Services echoed this conservative ethos, ultimately advising shareholders to reject Saylor’s temptations. These recommendations should not be undervalued in the discussion; they demonstrate a climate of caution among institutional investors who may prioritize consistent returns and long-term viability over potentially explosive but volatile gains.

A Broader Implication for Corporate America

The clash between Saylor and Microsoft is emblematic of a growing divide within corporate America concerning the adoption of cryptocurrency. On one hand, you have advocates like Saylor who view bitcoin as a revolutionary asset, poised to redefine how companies think about cash management. On the other hand, the more cautious voices that prioritize the fundamental principles of fiscal responsibility and risk assessment.

Saylor’s personal fortune, bolstered by MicroStrategy’s significant bitcoin holdings, adds another layer of complexity. His net worth, currently estimated at $9.1 billion, raises questions about the extent to which personal vested interests might color corporate strategies. Additionally, his willingness to use traditional methods like stock sales and debt raises to fund bitcoin purchases underscores a level of financial audacity that may not resonate equally with other corporate leaders.

The Future Landscape of Cryptocurrency Integration

As discussions continue, a crucial element remains in play: the long-term viability of cryptocurrencies. Should market conditions evolve favorably, the narrative could shift significantly, potentially aligning more corporations with Saylor’s vision. For now, Microsoft’s decision to reject Saylor’s proposal illustrates the balance that must be struck between innovation and prudence.

The ultimate outcome of this ongoing tug-of-war will likely influence how corporations strategize their financial frameworks in an increasingly digital economy. Bitcoin may indeed form part of that framework in the future, but it will require a significant cultural shift within corporations that traditionally shy away from high-risk investments. As the narrative around cryptocurrency develops, one can expect the conversations to become more intricate, revealing deeper insights into corporate strategy, investment philosophy, and the evolving landscape of digital finance.

Leave a Reply