The world of cryptocurrency is notorious for its volatility, and the latest news involving Trump Media and Bakkt exemplifies this reality. As reported by the Financial Times, Trump Media is reportedly in advanced negotiations to acquire Bakkt, a prominent cryptocurrency trading firm. This article will explore the implications of the acquisition, the backdrop of both companies, and the potential outcomes in a rapidly evolving financial landscape.

The Surge and Speculation in Stock Prices

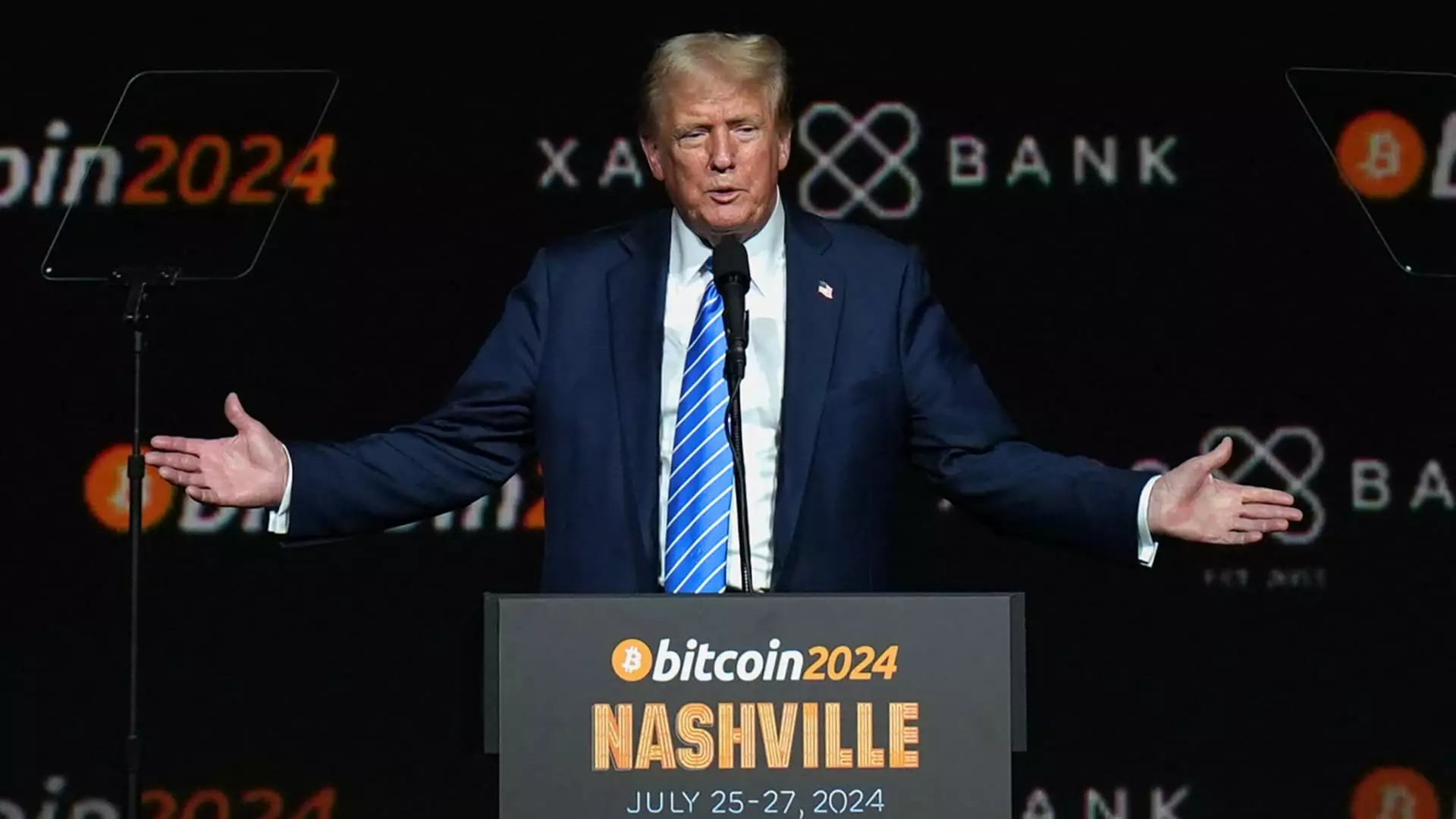

Upon the announcement of these talks, the stock prices of both Trump Media and Bakkt experienced a remarkable uptick, indicative of investor enthusiasm. Trump Media, under the helm of President-elect Donald Trump, saw a surge of over 16% in share value, trading under the Nasdaq ticker DJT. Concurrently, Bakkt, initially founded by Intercontinental Exchange (ICE), experienced a staggering rise over 162%, leading to repeated trading halts due to noted volatility. This reaction underscores how interconnected the narratives surrounding political figures and market sentiment can be, especially as the public anticipates developments in the cryptocurrency arena.

A notable aspect of Bakkt’s history is its leadership ties to Trump’s circle. Kelly Loeffler, a former CEO of Bakkt and a significant player in the financial sector, served as the co-chair of Trump’s inauguration committee. These interconnections raise eyebrows as they hint at a broader web of influence—an intersection where politics, business, and cryptocurrency converge. Loeffler’s prior role at Bakkt followed a series of career shifts that culminated in her brief tenure as a U.S. Senator, where she faced electoral defeat in 2021. The entangled histories of Loeffler, Trump, and Bakkt provide a fertile ground for speculation and scrutiny as the acquisition talks progress.

Despite managing to maintain a significant market cap exceeding $7 billion, Trump Media’s financial reports reveal a stark contradiction: a staggering net loss of $363 million against a mere $2.6 million in revenue for the year. This paradox may suggest that investor sentiment is leaning heavily on potential rather than present financial health. Trump Media’s cash reserves stand at about $673 million, which may provide a buffer as it navigates this speculative landscape.

Conversely, Bakkt finds itself grappling with its financial viability. The company reported revenues of $328.4 million for its latest quarter, yet it also revealed an operating loss of $27.4 million. Notably, Bakkt’s management issued alarming warnings regarding its long-term sustainability, exposing deeper vulnerabilities that could potentially undermine its stockholders’ investments. The specter of delisting from the New York Stock Exchange due to trading below the minimum threshold adds another level of uncertainty to Bakkt’s future.

If the acquisition materializes, it could signify a significant strategic expansion for Trump Media into the burgeoning cryptocurrency sector. In November 2023, Trump had already demonstrated interest in the crypto domain by promoting a new token linked to the venture World Liberty Financial, which promises immense returns for Trump and his family with minimal risk exposure. This venture aligns with broader trends as companies and political figures increasingly engage with cryptocurrency, often as a mechanism to capitalize on investor speculation and technological innovation.

However, skepticism remains regarding the sustainability of such ventures. As regulation in the cryptocurrency market continues to evolve, and with unpredictable market dynamics, questions linger about the long-term viability of both entities post-acquisition. Would the union result in a robust business capable of weathering the storms of market fluctuations, or would it merely serve as the enabler of more speculative trading?

The reported negotiations between Trump Media and Bakkt present a compelling narrative within the shifting landscape of cryptocurrency investment and political influence. While stock price surges suggest optimism, the underlying financial weaknesses of both entities reveal a complex picture fraught with uncertainty. As the future unfolds, stakeholders must navigate this intricate web of finance and ideology, keeping an eye on political maneuvers and market trends that could impact the realms of both cryptocurrency and corporate governance. The outcome of this acquisition could serve as a litmus test for the interplay between politics and the crypto market in an era defined by rapid change and speculation.

Leave a Reply