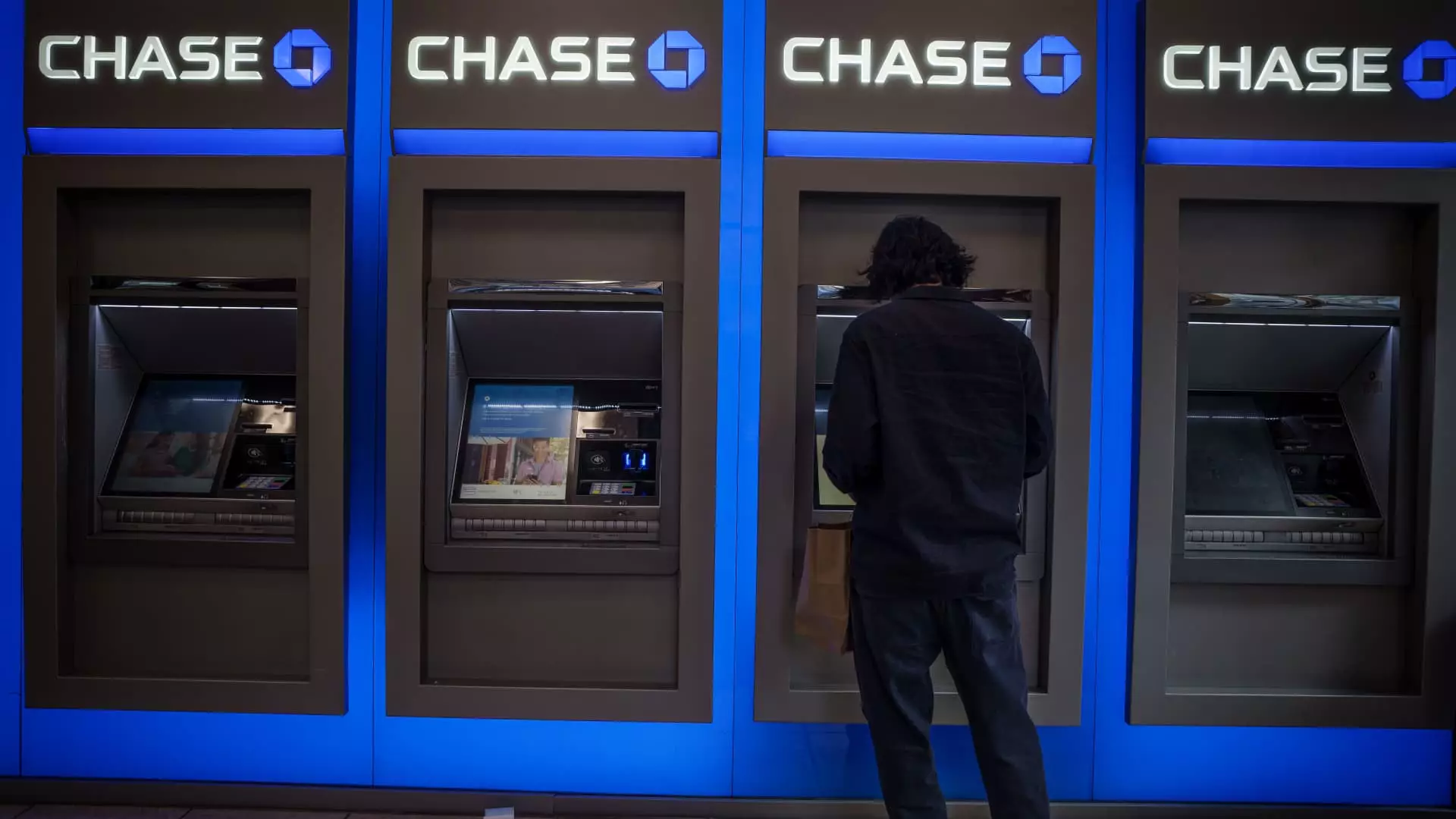

In August 2024, a new financial scandal known as the “infinite money glitch” came to light, showcasing just how quickly social media can influence fraudulent behavior in banking. The situation saw individuals exploiting a technical loophole at JPMorgan Chase, one of the largest banks in the United States, to withdraw large sums of money before the realization of bounced checks deposited at ATMs. The unsettling trend gained traction on platforms like TikTok, where videos showed people proudly flaunting the cash they had extracted moments after depositing a bad check. This alarming phenomenon has raised serious questions about the bank’s vulnerability and the banking system’s reliance on technology that can potentially be manipulated for deceit.

In response to the rampant misuse of their banking system, JPMorgan Chase has initiated legal action against several customers implicated in the glitch. The bank has filed lawsuits across multiple federal courts, including cases in Texas, Miami, and California, targeting individuals accused of withdrawing significant amounts of money tied to counterfeit checks. In one notable instance from Texas, a man allegedly owes the bank nearly $291,000 after an accomplice deposited a $335,000 fake check. This bold strategy by JPMorgan seeks to reclaim millions extracted by fraudsters, sending a clear message that the bank will not tolerate financial misconduct.

JPMorgan’s legal strategy focuses on filing civil lawsuits, which illustrate the gravity of the situation and its potential long-term ramifications. By prioritizing cases with larger amounts, the bank hopes to discourage similar behavior among other customers who might consider exploiting the bank’s systems. Such litigation also underscores the essential principle of corporate accountability, wherein institutions take a stand against fraud, thereby reinforcing consumer trust in the banking system as a whole.

As digital payment systems gain traction, checks still represent a considerable vulnerability for financial institutions. According to Nasdaq’s Global Financial Crime Report, check fraud resulted in a staggering $26.6 billion in losses globally in the previous year alone. The “infinite money glitch” is merely one instance in a long line of fraudulent activity linked to checks, revealing how despite advances in technology, traditional forms of banking are still susceptible to manipulation.

Moreover, the recent spike in ATM-related fraud illustrates a broader issue within banking institutions themselves—how well are these entities prepared to protect against emerging threats? The incident emphasizes the importance of robust security protocols and the need for banks to remain vigilant against potential vulnerabilities, especially in a world where social media can instantaneously spread ideas and techniques for exploitation.

Implications for Regulatory Frameworks and Law Enforcement

The leaked information regarding JPMorgan’s investigations has significant implications for regulatory frameworks within the banking sector and law enforcement practices. Banks face the challenge of navigating a rapidly evolving digital landscape while safeguarding themselves against sophisticated fraud. The decision by JPMorgan to refer cases to law enforcement highlights the interconnected nature of financial fraud and crime prevention, suggesting that collaboration between private institutions and public entities may become increasingly vital in combating fraud.

In addition, the lawsuits may prompt lawmakers to reconsider existing regulations governing banking practices, particularly regarding check processing and fraud detection systems. Continuous improvements to technology and oversight mechanisms will be essential in preventing future incidents and protecting both banks and their customers.

The unfolding drama surrounding the “infinite money glitch” serves as a stark reminder of the ongoing vulnerabilities in the financial system that need to be addressed. As JPMorgan Chase seeks to recoup losses through legal action, the episode prompts reflection on the importance of robust banking practices in preventing fraud and reinforcing consumer trust. The incident is a crucial learning opportunity for financial institutions as they work to strike a balance between leveraging technology and ensuring security. Moving forward, the collaboration between banks, regulators, and law enforcement will be crucial to fortifying the banking system against potential abuses, creating an environment where trust and safety coexist.

Leave a Reply