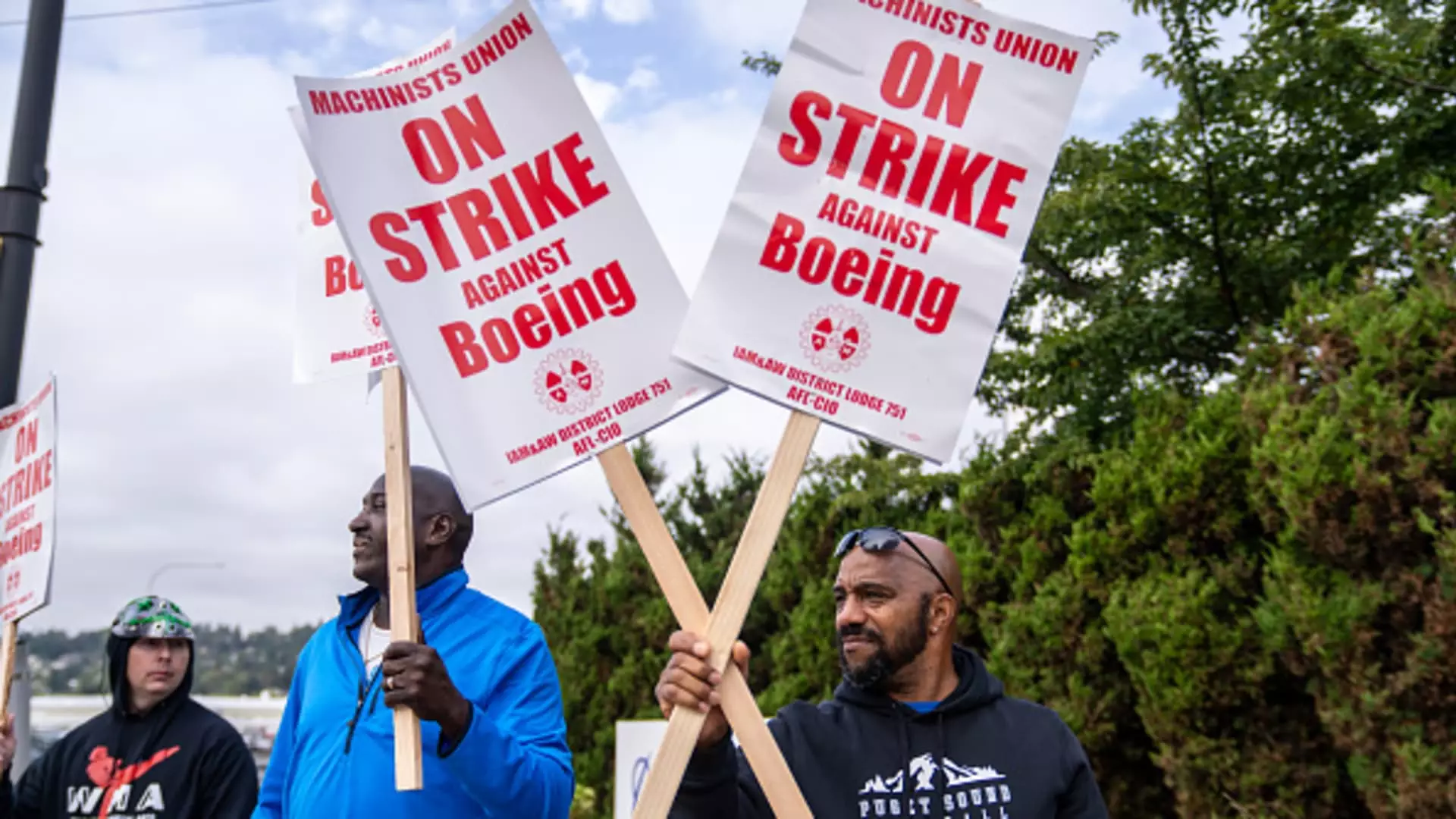

Boeing, a historical leader in the aerospace industry, is currently experiencing one of its most tumultuous periods yet. Over 30,000 machinists participated in a significant strike that began following their rejection of a tentative contract—a decision reflecting deep-seated discontent among employees. This labor action has not only disrupted production but also exacerbated the already precarious financial state of the company, leading to escalating costs and challenges for Boeing’s new CEO, Kelly Ortberg, who has been tasked with navigating this turbulent environment.

In an industry already beset by difficulties stemming from design flaws and a history of tragic accidents, the timing of this strike could not be worse. The year had already begun with serious setbacks, including a critical incident involving the 737 Max. Six years after two catastrophic crashes that deeply traumatized the brand, the company appears trapped in a cycle of crisis management. Estimates from S&P Global Ratings indicate that the strike is costing Boeing upwards of $1 billion monthly, severely impacting cash flow and operational stability.

The current standoff between Boeing and the International Association of Machinists and Aerospace Workers underscores a larger tension in labor relations. Despite both parties entering negotiations with some initial optimism, the wind quickly shifted. The union’s overwhelming rejection of the proposed deal, with a staggering 95% of members voting it down, illustrates a significant disconnect between management offerings and worker expectations.

Kelly Ortberg, who took over in the summer amidst a crisis-ridden narrative, finds himself facing increasing scrutiny. Labor expert Harry Katz from Cornell University predicts that Boeing will have no choice but to enhance its contract proposals to attract workers back, yet he also cautions that some key union demands—particularly the reinstatement of a pension plan—are unlikely to materialize.

Recently, Boeing’s management accused the union of bad faith negotiations, filing a complaint with the National Labor Relations Board. Such actions signal not just a breakdown in dialogue but a potentially dimming prospect for resolution. As Jon Holden, the union’s president, emphasized, the future of any negotiated agreement rests firmly in the hands of the workforce, which is increasingly restless and in search of meaningful resolutions.

With the strike ongoing, the immediate impact on machinists has been severe: workers are now without paychecks and have lost access to vital health insurance benefits. Unlike previous strikes, however, the current job market in the Seattle area is more robust, offering alternative employment options. Union message boards are busy with listings for jobs in various sectors, including driving and warehousing.

Despite the hopeful prospect of alternate income, many workers feel uncertain. The company’s announcement of a future 10% reduction in the global workforce adds another layer of anxiety for employees. These cuts, affecting a range of positions from executives to frontline employees, suggest deep financial concerns within the organization. With expectations of losing nearly $10 per share in its next quarterly results, Boeing’s financial health appears alarmingly fragile.

Boeing’s current operational challenges are not limited to labor disputes. With significant delays in the 777X production timeline and unfulfilled commercial contracts, investor confidence is wavering—evidenced by a staggering 42% drop in share value over the year. Analysts are now speculating about the potential for a major equity raise of up to $15 billion as the company combats its mounting debts.

Richard Aboulafia, an aerospace advisory expert, notes the folly in cutting positions essential to stabilizing production. Labor, responsible for merely 5% of total aircraft costs, is a vital piece in the puzzle of returning Boeing to profitability. By undermining its workforce at this critical juncture, the company risks further exacerbating its financial woes.

As the labor strike continues and financial pressures mount, Boeing stands at a crossroads. The decisions made in the coming weeks will have far-reaching implications for the company’s operational health, employee morale, and investor trust. If a resolution is not reached soon, Boeing risks slipping deeper into a cycle of crisis that could tarnish its legacy as one of the aerospace industry’s giants. The path ahead demands a delicate balance—addressing the legitimate concerns of its workforce while simultaneously seeking innovative solutions to restore financial stability and operational efficacy. The eyes of the world are watching as Boeing grapples with its most significant internal challenge yet.

Leave a Reply